File your year-end accounts with Companies House on time ensuring to avoid penalties.

Prepare and file your CT600 corporation tax return with HMRC, ensuring accuracy and timely submission to avoid penalties

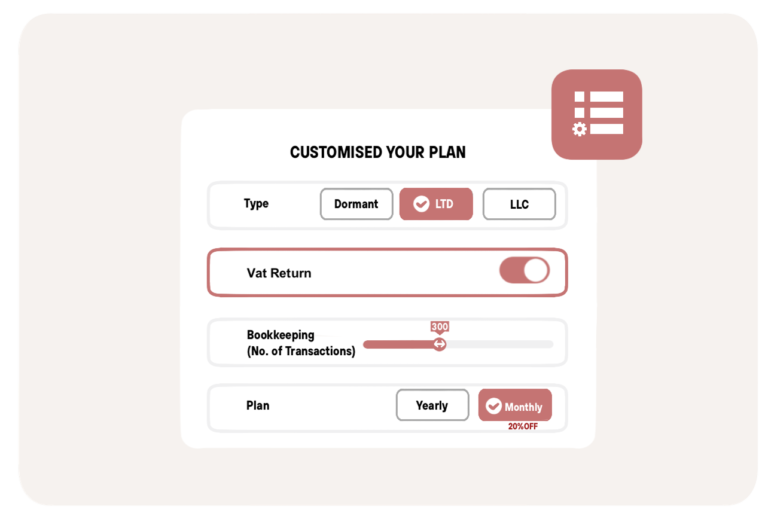

Get free bookkeeping services (up to 300 transactions) in all packages.

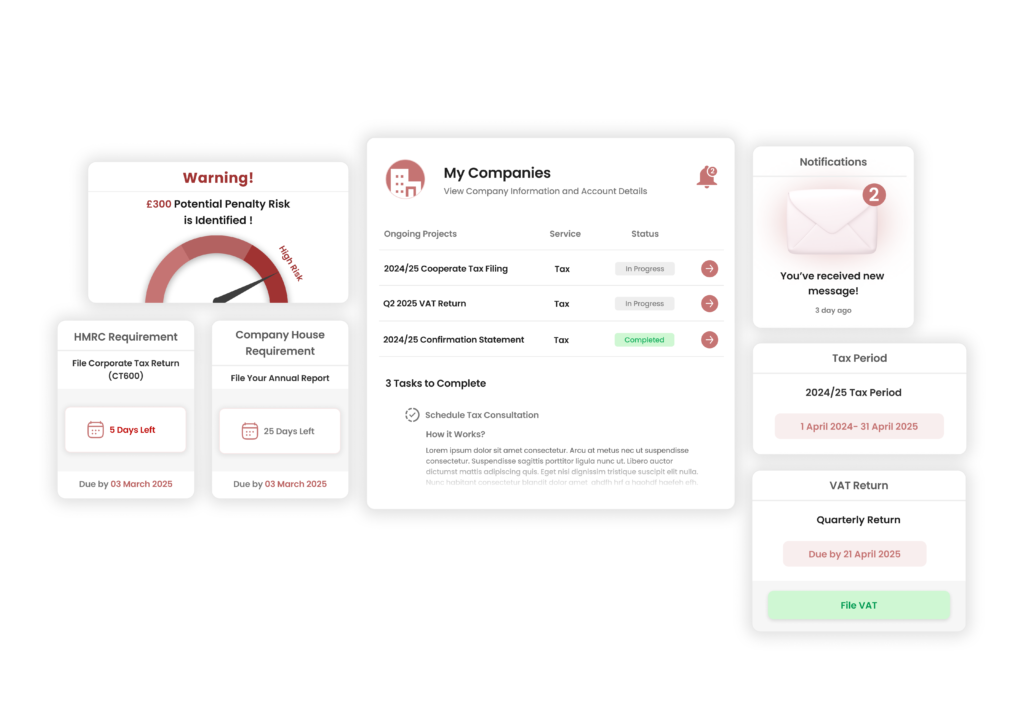

Monitor and control government deadlines with our AI-driven alert solutions, simplifying the management of requirements with the Companies House and HMRC.

File your year-end accounts with Companies House on time ensuring to avoid penalties.

Prepare and file your CT600 corporation tax return with HMRC, ensuring accuracy and timely submission to avoid penalties

Get free bookkeeping services (up to 300 transactions) in all packages.

Monitor and control government deadlines with our AI-driven alert solutions, simplifying the management of requirements with the Companies House and HMRC.

Best for active micro-entities

Annual account preparation and submission to Companies House

Tax return prepartion and sumission to HMRC

Preparation of Balance Sheet and Income Statement ( up to 1,000 transactions )

Real time alerts and updates of all filing-related issues

Complete coverage for any type of business

All included in the Essential Plan

Confirmation Statements, VAT & PAYE Registration

Flexible VAT returns services with quarterly, or yearly filing options

No limit on the number of transactions for bookkeping

Annual account preparation and submission to Companies House

Fast solution for inactive and dormant companies (with no business activities).

Prepare and file dormant accounts to Companies House and HMRC.

Incl. Access to Smart Compliance Dashboard

Flexible VAT returns services with quarterly, or yearly filing options

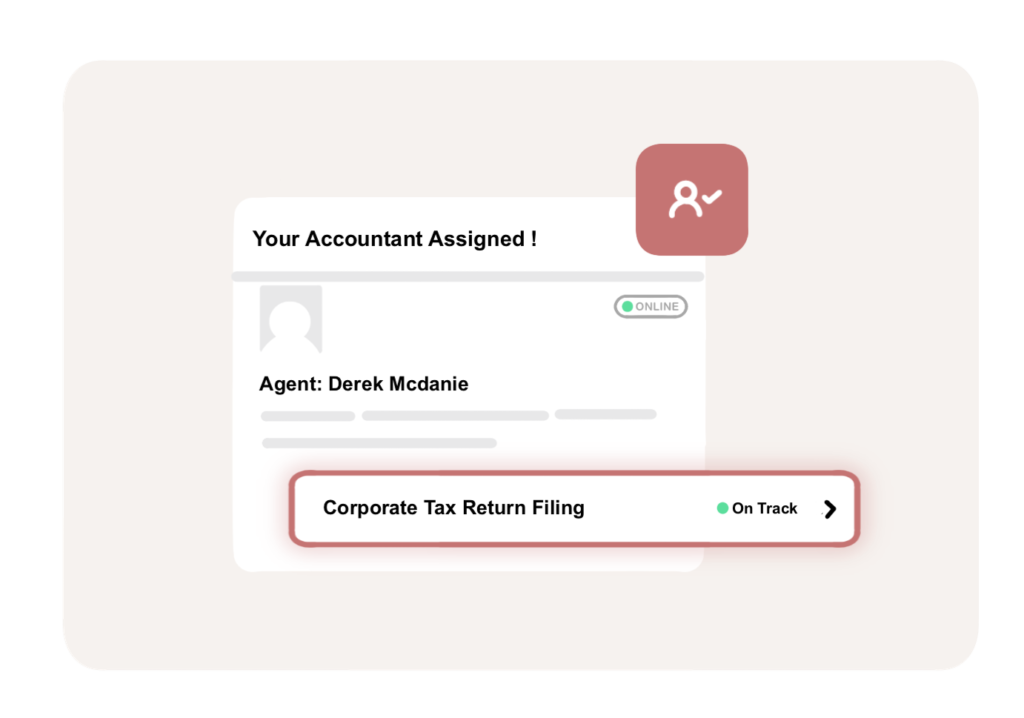

Dedicated agent is assigned to ensure accuracy and timely submission to HMRC

Annual Company Account Filing

Corporate Tax Return – CT600

24/7 Live Agent Support

Dedicated Bookkeeping Services

Smart Compliance Alert

VAT Return

VAT / PAYE Registration

Tax Advisory / Consulting Sessions

$297/yr

Billed Annually at $297

+ State Fees

$297/yr

Billed Annually at $297

+ State Fees

I have been running a limited company as a non-uk resident and tax filing has been always a hassle and a painstaking process. But with Grid Club services, I was able to get the tax jobs done completely stress-free. Very responsiveness and happy with the seamless process. I would like to use the services going forward.

We have recently switched to Grid Club for our VAT returns and it was a right decision. Very fast completion at reasonable prices. The overall process was very simple and swift. Appreciate your responsiveness.

Mo is an incredibly professional accountant. I have worked with him for many years. He is loyal, honest and trustworthy. I will continue to use his services.

Thank you Mo for everything. You have greatly assisted me and my businesses.

They provide decent company accounting services and have good cs support

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.